Want to save money next year? Try this two step method!

31 Tuesday Dec 2013

Written by J. Abram Barneck in Random Life

Tags

No tags :(

Share it

Ever heard the term “living paycheck to paycheck”? We all have heard of it and many of us are actually doing it.

Is this you? Many people are incapable of living any other way. Have you tried to budget and have failed. Have you waited until you bank account is zero and only stopped spending to avoid overdraft fees.

What if I told you that you could live paycheck to paycheck and still save 10%. Well, you can. It is so simple.

How? Just save the money before it is transferred into your checking account.

No, I am not talking about a 401K, though I do recommend you contribute to one.

I am talking about Direct Deposit. You are in control of where your money goes!

I am talking about Direct Deposit. You are in control of where your money goes!

Two easy steps to saving money and still living paycheck to paycheck:

- If you don’t already have a savings account, open one.

Often savings accounts are free, but sometimes they require an up front deposit.

You can probably open a saving account in minutes.

Check your bank’s online site.

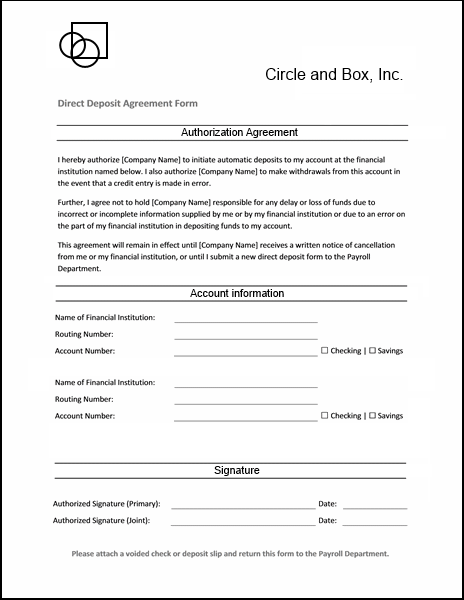

Or you can grab your debit card and call the number on the back and talk to a representative. - Go to your HR department and fill out a new direct deposit form. It should look something like the image you see.

Change the form to put 10% into your saving account and the rest into your checking account.You need to understand what 10% means. Let us say your net pay to your checking account was $1000 every two weeks but your gross is $1500. Well, 10% is going to be of gross, so $150 will go to savings, leaving $850 to go to your checking account. If you are looking to save 10% of net, then in this example, 6% would be $90 and 7% would be $105. Grab a calculator and figure it out for your salary.

Well, that was it. Two steps and now you have a savings account and now 10% is going to be transferred to it before you ever see it.

Now when you live paycheck to paycheck, you will see your checking account reach zero. As you are living paycheck to paycheck, you will stop spending only to prevent overdraft fees. But you will have only spent 90% of your money.

Do your best to forget about the saving account, but don’t worry if you have to dip into it for emergencies because emergencies are exactly what a savings account is for.

Have fun with your new “living paycheck to paycheck and still saving” life style.